A growing number of S&P 500 firms are reducing their transparency about race and gender. As political pressure mounts, companies are choosing silence over scrutiny.

The war on DEI has become a hallmark of Trump’s second term. He has eliminated DEI programs across the federal government, threatened to withhold funding from universities that maintain DEI initiatives, and instructed the Attorney General to crack down on “illegal private-sector DEI” programs. In response, many companies are quietly pulling demographic data from public view.

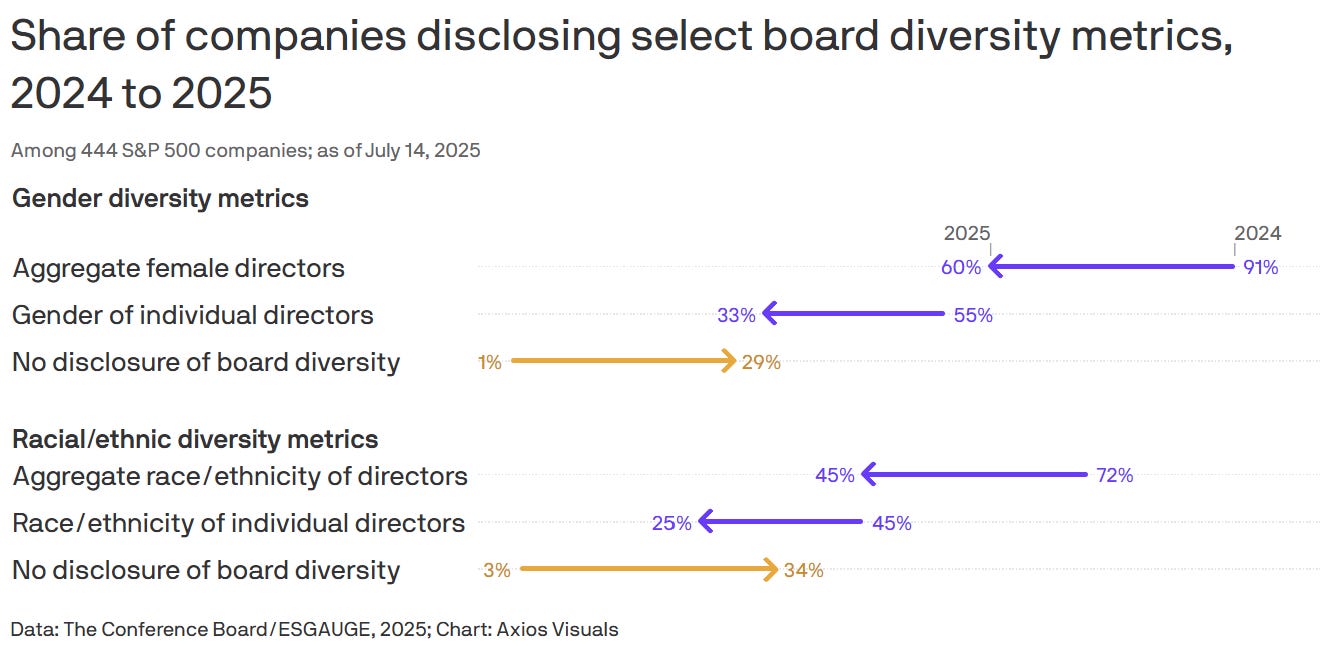

According to a report by the Conference Board and the analytics firm ESGAUGE, a growing number of S&P 500 firms have stopped disclosing board diversity data. In 2024, 91% of firms reported the number of female directors. By 2025, that figure dropped to just 60%, a 31-point decline. The share reporting the race or ethnicity of board members also fell, from 72% to 45%. Just 1% of companies failed to disclose any gender data in 2024; today, that share has jumped to 39%. Non-reporting on race and ethnicity rose from 3% to 34%.

This report doesn’t necessarily reflect a change in hiring practices, but it does show a clear shift in transparency. And some major firms, from John Deere to Goldman Sachs, have publicly dropped their DEI programs.

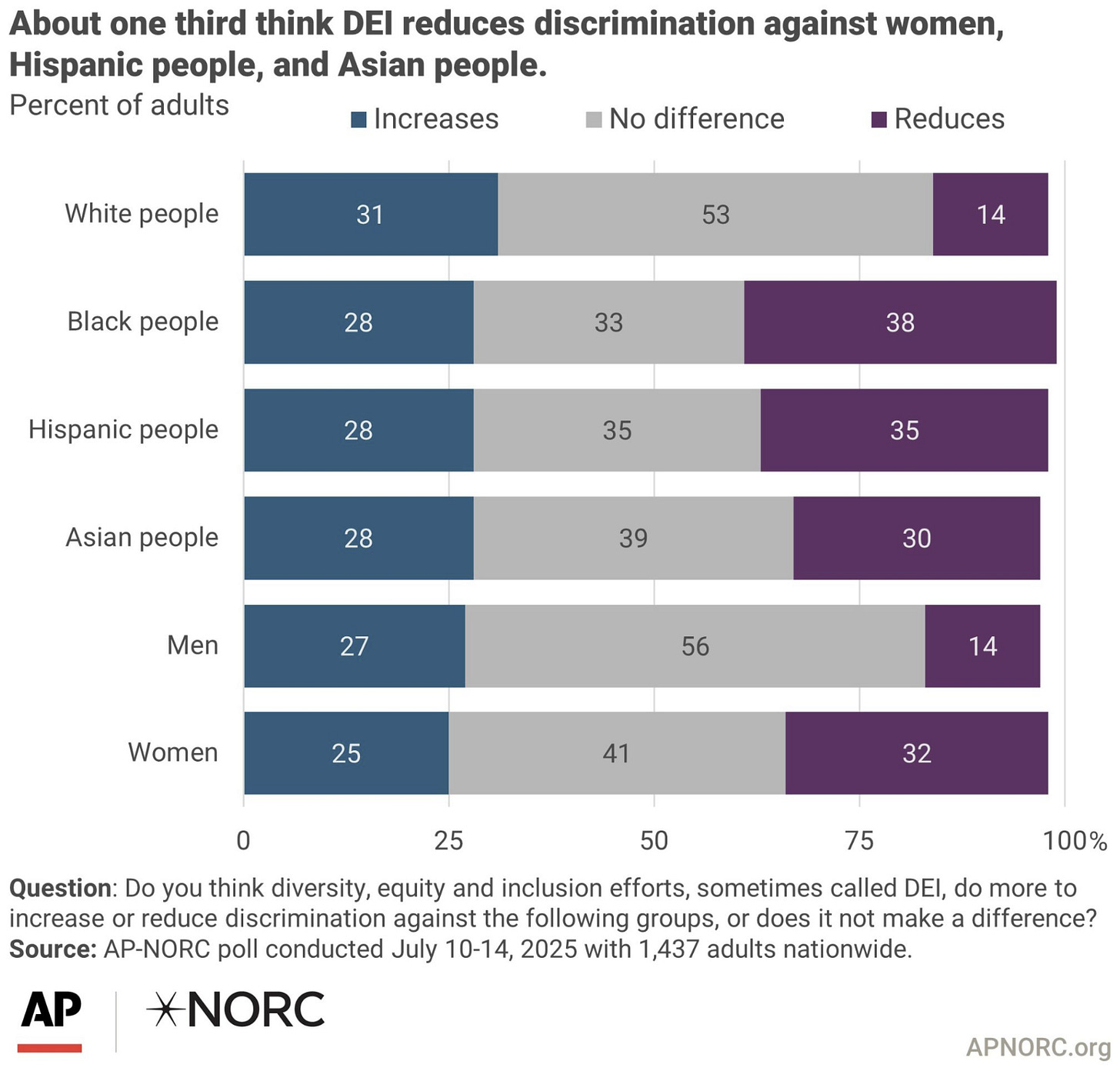

The backlash isn’t coming from Trump alone. Public sentiment appears to be shifting too. A July AP-NORC poll found that more than half of U.S. adults now believe DEI programs either make no difference or actually increase discrimination. Meanwhile, just 45% say black Americans face “a great deal” or “quite a bit” of discrimination, a 16-point drop since 2021. (See “Support for DEI Declines.”)